I have a simple rule of thumb when it comes to news reports. The real story is always in the penultimate paragraph. Let's look at this inflammatory headline: Woman’s 'spree' after $158k banking error, refuses to return pensioner’s life savings An Auckland beneficiary is under investigation for an alleged “spending spree” after $158,000 was mistakenly transferred to her account. […] pensioner lo…

Continue reading →

This is a bit niche! A few months ago, I received a mysterious £25 from National Savings and Investments. A prize from the Premium Bonds! Not enough to make me rich, but enough for a takeaway. Oddly, after checking their app and website, I could find no record of the win. Curious. A few days later, this letter popped through my door. My bond was one of a tranche purchased in 2013. I sold it …

Continue reading →

There's currently an open consultation about whether banks should have a lower compensation limit to refund their customers who have been scammed. Currently, if a customer falls for an Authorised Push Payment (APP) scam, they may be eligible for up to £415,000 back from their bank. The proposal is to limit this to a maximum of £85,000. What does this mean and is it a bad thing? APP fraud is w…

Continue reading →

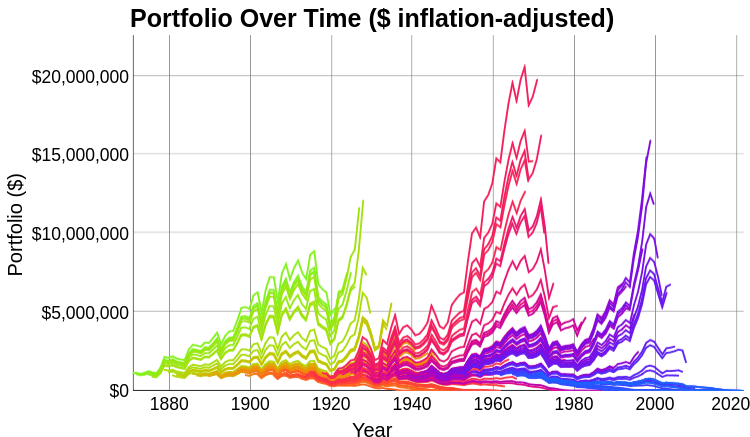

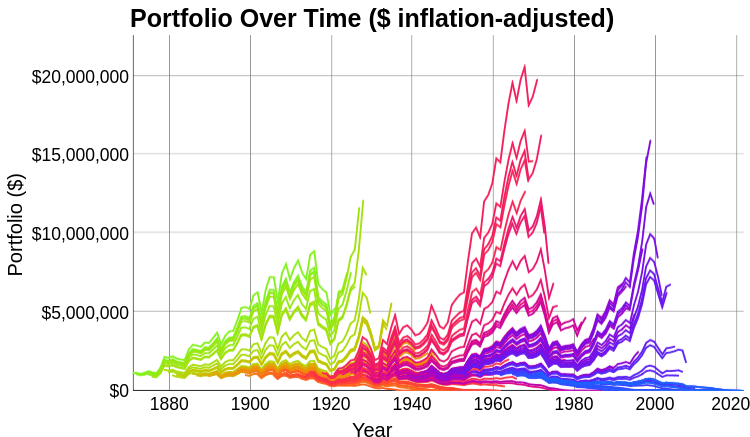

It's sometimes useful to run experiments yourself, isn't it? New investors are often told that, when investing for the long term rather than chasing individual stocks, it is better to be invested for the longest possible time rather than trying to do "dollar cost averaging". DCA is the process of spreading out over time the purchasing of your investments. That way, you don't lose it all if the…

Continue reading →

Everyone's favourite tabloid, The Daily Telegraph, contains an article decrying the Financial Independence Retire Early philosophy I have a mixed relationship with the FIRE movement. It basically boils down to "spend less, save more, then you can retire once you've save 25x your annual spend". That's it. As Michael Taylor writes, some people fetishise the "spend less" part. If you deny…

Continue reading →

Brits hate talking about money. But this benefits no-one. This is my situation - it's probably different to yours. I'm acutely aware I'm in a better financial position than most. This isn't financial advice - but I'd sure appreciate anyone's thoughts. I've recently moved down to a 4-day-a-week job. Taking a 20% hit to my salary felt like a moment of madness. But it was part of a (somewhat)…

Continue reading →

As I mentioned last week, MoneyDashboard is shutting down. They are good enough to provide a JSON export of all your previous transactions. It is full of entries like this: { "Account": "My Mastercard", "Date": "2020-02-24T00:00:00Z", "CurrentDescription": null, "OriginalDescription": "SUMUP *Pizza palace, London, W1", "Amount": -12.34, "L1Tag": "Eating Out", …

Continue reading →

A few weeks ago I was moaning about there being no OpenBanking API for personal use. Thankfully, I was wrong! As pointed out by Dave a company called Nordigen was set up to provide a free Open Banking service. It was quickly bought by GoCardless who said: We believe access to open banking data should be free. We can now offer it at scale to anyone - developers, partners and Fintechs - looking…

Continue reading →

The recent news that MoneyDashboard is suddenly shutting down has exposed a gap in the way OpenBanking works. It is simply impossible for a user to get read-only access to their own data without using an aggregator. And there are very few aggregators around. Why is it impossible for me to get programmatic access to my own data? There are two interlinked reasons which I'd like to discuss. …

Continue reading →

My wife and I run a side project called OpenBenches.org - it is a fun little crowd-sourced memorial bench site. It's mostly fun, except when the bills come due! Most hobby sites and side projects don't cost a lot to run. Lots of services have generous free tiers to (ab)use, and they can pay well in "exposure". But OpenBenches is reaching a tipping point where it is slowly overwhelming us. …

Continue reading →

I'm not sure how many people know this, but I thought I'd share something I learned a few years ago when I worked for a mobile phone seller. Most modern smartphones are too expensive for people to purchase outright. At the most extreme end, the iPhone 14 Pro Max costs £1,200. So a typical customer elects to pay £50 per month for 24 months. The customer gets a new phone for a reasonable monthly …

Continue reading →

My wife and I are planning on being DWZ DINK FIRE. That's a lot of letters to say we want to retire early and not leave any money to our non-existent kids. This book is a (slightly shallow) exploration of 26 people on similar journeys. They're all American (or now living in the USA) so it has a slight bias to talking about things like 401(k) and medical bills which are absent in most other…

Continue reading →